Earlier this month the Senate Banking Committee began a process that will take a long, hard look at the way American banks handle the credit card industry. Some of the items on the agenda include annual fees, credit card expiration dates, universal default pricing, double-cycle billing and late payment policies (to name a few). Each of these banking practices plays a major role in the way issuers handle your account, and the changes may very well impact your favorite credit card program. For the next few days, we’ll take a look at what each of these industry terms mean and how they affect your everyday life.

Day Four: Double Cycle Billing

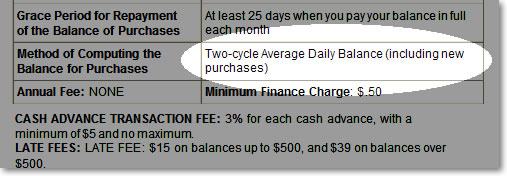

Perhaps the most disturbing method of balance computation out there, double-cycle billing is practiced by over one-third of the credit issuing banks in the United States. The idea behind this billing method is the charging of interest on the total amount lent to a consumer during a billing cycle – not the amount remaining after that consumer pays their monthly bill. This means if you charged $2,000 on a credit card that computes interest using the double-cycle method and paid back $1,800 of that balance, you would still be assessed interest on the full $2,000 charge rather than the remaining $200 that you did not pay back completely.

Double-Cycle Billing By The Numbers

Let’s take a look at the numbers behind this practice. We will continue to use the $2,000 charge with $1,800 payment as previously mentioned. We will also assume an 11.24% interest rate in both cases, which is currently a fairly decent rate for people with good-to-average credit.

Double Cycle Billing Method

$2,000 x (11.24% / 12) = $18.73 paid in interest

Regular Billing Method

($2,000 - $1,800) x (11.24% / 12) = $1.87 paid in interest

The card with the double cycle billing paid $16.86 extra in one month – this means the card could cost them upwards of $200 per year extra just because of the billing method!

How to Avoid Double Cycle Billing

A recent Consumers’ Union study showed that more than 68% of people who used cards with double-cycle billing had no idea that their account was affected. What’s more, 92% of those consumers had non-double cycle billing cards available to them (sometimes double cycle credit cards are the only option for consumers who have less than perfect credit.)

What does this mean?

Some credit card companies will lure you in with fancy reward programs and other options, keeping the billing computation method in the fine print all the while. Say no to double cycle balance computations – make sure you know what you’re getting into before you apply!

Additional Resources:

Kimberly Carte

Team Your Credit Network