- No introductory rates

- Variable APR

- $300 up to $10,000 limit

Alright here’s the situation, your credit is poor, you have a large purchase you’re looking to finance, but have no way to pay for it! Well take a look at this. It’s the Bank of America Secured Visa Platinum card. That’s right a secured, platinum card offered strictly for those with poor credit scores. Many people run into the problem of acquiring a unsecured credit card when their credit score has dropped, with the help of this credit card you can get your finances back on track.

Reasonable Pricing

Although this program is a secured credit card the used is still offered many rewarding benefits. For instance, the card comes with a $29 first year fee, which is quite reasonable for a secured credit card. The card also comes with Bank of America’s Free Total Security Protection offer and free, award winning, online banking. That’s not all the program even offers you the chance to personalize the card with Photo Expressions.

Poor Credit Applicants

Applying for a credit card with poor credit can be quite difficult, until now. If you are ready to start building your credit score and want to do it in an inexpensive manner we suggest the Bank of America Secured Visa Platinum card. With a credit limit from $300 up to $10,000 and no introductory rates it is clear to see why this card is so popular.

Additional Resources:

- 1.99% APR on balance transfers for 12 months

- 9.99% regular APR (fixed)

- Credit line as high as $250,000

- 1% cash back on almost all purchases

If you have very good credit and would like a credit card with a cash-back rewards program, you should consider the Total Merrill Cash Back Visa card. The Total Merrill Cash Back Visa gives customers the choice of receiving cash back or having deposits made automatically to a Merrill Lynch account. In this post, we’ll explain the basics of the Total Merrill Visa and what makes it stand out among the competition.

Total Merrill Cash Rebate Program

Through the Total Merrill Cash Back Visa card reward program, cardholders earn one credit for every dollar spent on almost all purchases. As your credits accumulate, you have the option of receiving a cash reward check or having the credits deposited directly into your Merrill Lynch Cash Management Account or Beyond Banking account after you earn 5,000 credits. There are no limits on the number of credits you can earn. However, cash reward checks expire 90 days after they are issued.

Other Card Benefits

The Total Merrill Cash Back Visa also comes with an attractive 1.99% APR on balance transfers for the first 12 months. This rate also applies to cash advances during the first 12 months. The regular APR is a fixed, competitive rate of 9.99%. The low purchase APR will save cardholders who carry a balance a substantial amount of money on interest. Thus, if you have very good credit, intend to take advantage of the cash rebate program, and occasionally carry a balance, the Total Merrill Cash Back Visa card is an excellent choice.

Additional Resources:

- 0% introductory APR for 12 months on balance transfers

- 9.99% regular APR (fixed)

- No annual fee

- Earn EarthSmart points for every dollar

Did you know you can help protect the environment just by using your credit card? With the Brighter Planet Visa credit card, you can do just that. In this post, we’ll cover the basics of the Brighter Planet Visa and explain what makes it unique.

Go Green with Your Credit Card

The Brighter Planet Visa credit card offers one of the most unique rewards programs in the business. With every dollar you spend on purchases, you will earn one EarthSmart point. These points will be automatically redeemed to help fund renewable energy projects. After your first purchase, you will earn 1,000 bonus EarthSmart points. You also receive 1,000 bonus points for signing up for paperless billing. Additionally, until December of 2008, Bank of America will make a matching contribution of one additional point for every two points earned by a cardholder. The company estimates that every 1,000 points cardholders earn will pay for about one ton of carbon offsets. Thus, this card is ideal for consumers who want to support an organization that helps protect and monitor the environment.

Added Benefits

The advantages of the Brighter Planet Visa credit card extend far beyond the rewards program. For one, the card comes with an unbeatable, 12-month introductory 0% offer on balance transfers. The regular APR is a competitive 9.99% and fixed, which means you will not have to deal with wild fluctuations in your interest rate. Cardholders also have the option to create a profile on the Brighter Planet website, which allows them to track their impact on the environment. The Brighter Planet Visa also offers traditional cardholder benefits, such as online account access, fraud protection, and mini card service. You receive all of these benefits for no annual fee.

Additional Resources:

If you are in school and would like the opportunity to begin building credit toward your financial future, the Bank of America Student Visa Platinum Plus credit card is just the tool you need to do it. This card is for students with very good credit who are looking for a good credit card with which to start out. In this post, we’ll give you some basic information about the card and why it’s right for you.

At a Glance: Bank of America Student Visa Platinum Plus Credit Card

- No co-signer required

- No annual fee

- Balance transfer/cash advance fee of 3% of each transaction

- Variable purchase APR of 19.24%

- Build good credit history

- Perfect for students at a college or university

- Platinum prestige

About the Card

The Bank of America Student Visa Platinum Plus Credit Card is for people over 18 years old who attend an accredited 2- or 4-year university at least part-time. For no annual fee, you can enjoy the prestige of carrying a platinum card and the chance to build your credit history. This card is meant for those with very good credit. No co-signer is required to qualify. The APR on purchases is 19.24%, which means this card is best-suited for people who plan to pay off their balances in full each month. The balance transfer APR is also 19.24%. For cash advances, you will pay an APR of 24.24%. The transaction fee for balance transfers and cash advances is 3% of each transaction.

Platinum Benefits

Because the Bank of America Student Visa Platinum Plus card is platinum card, you will enjoy the platinum-level benefits that accompany this status. You will have access to online banking services, which means you can check you balance and pay your bills conveniently from your computer. You will also enjoy Total Security Protection, which includes zero liability on unauthorized purchases as long as they are reported right away. Some of the other benefits you will receive include travel and emergency assistance, automatic auto rental insurance, purchase guard and replacement, additional cards for no extra charge, and cash advance checks for no additional charge.

Additional Resources:

Did you know you can help pay off your mortgage just by using a credit card? It’s true! The Home Advantage MasterCard from Bank of America lets you earn a variety of rewards for using your card, including payments on your mortgage principal. In this post, we’ll give you general information about the card and what makes it unique.

The Basics of the Home Advantage MasterCard from Bank of America

- 0% introductory APR for 12 billing cycles

- Intro APR applies to balance transfers and cash advance checks

- 9.99% or 15.99% fixed regular APR, depending on your credit

- No annual fee

- Point-based rewards program

- Redeem points for payments toward mortgage

Pay Down Your Mortgage by Using Your Card

If you are looking for a credit card rewards system that is actually useful, the Bank of America Home Advantage MasterCard is for you. It lets you kill two birds with one stone—you will earn payments toward your mortgage just for using your credit card! Here’s how it works. You earn one point for every dollar you spend on qualifying purchases. No limit exists on how many points you can earn, and you have five years before the points expire. Best of all, you can arrange for payments to be made to your mortgage provider when you redeem points. Bank of America will make a $50 payment toward your mortgage principal for every 5,000 points you earn.

Earn Mortgage Payments and So Much More

The mortgage payment rewards program is a terrific feature of the Home Advantage MasterCard by Bank of America, but the card also has a lot of other attractive features. For one, you can redeem your points for travel rewards, gift certificates, merchandise, and cash in addition to mortgage payments. Rewards program aside, the Home Advantage card comes with stellar terms and rates. You will enjoy a 0% APR on balance transfers and cash advances for a full 12 billing cycles. For those who qualify, a 9.99% APR will be applied to purchases (15.99% for those without excellent credit). This card boasts no annual fee, which makes it truly unique among rewards credit cards. You will also get traditional cardholder benefits, such as online account access, personal concierge services, and fraud protection.

Click here to apply for the Home Advantage MasterCard from Bank of America today!

Additional Resources:

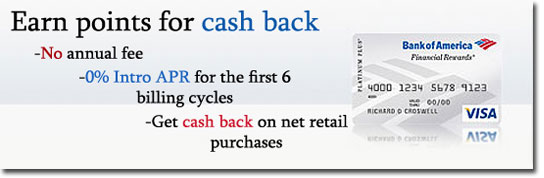

Another great card on Your Credit Network is the Financial Rewards Visa Platinum Plus card. This blog entry will cover the basics, and the benefits of the Financial Rewards card from Bank of America.

Financial Rewards Visa Platinum Plus Credit Card Basics

- No annual fee

- Variable APR (Prime Rate + 5.99%)

- 0% introductory rate for the first 6 billing cycles on cash advance checks and balance transfers

- Points Rewards

Benefits of the Financial Rewards Visa Platinum Plus Card From B of A

This card is designed for those who have very good credit. This card has rewards specific to earning cash back. This card has a very easy rewards program aimed at getting you rewards you want without the hassle. The rewards include:

- Earn 1 point for ever $100 in purchases per billing cycle

- 1 point = $1 you can use

- Receive 5 bonus points for every $2,500 in balance transfers ever billing cycle (25 per cycle)

- Points don't expire for 5 years

- Auto rental insurance, and travel accident insurance

This great system has a great reward system. Points are redeemable in 25 point sets. These can be used for cash back checks, or direct deposit made to your BoA savings or checking accounts. These points can even be used to lower the purchase APR on your card. As you can see, these are rewards you want, and can use. There is also an annual limit of 600 points. There may be a limit, but it does not hinder you ability to get the reward of cash back.

The Financial Rewards Visa Platinum Plus Card Is A Hit!

This Visa Platinum Plus card issued by FIA Card Services, N.A. is a winner. Cash back rewards, because they know what you really want.cash. That way you can get the money and do whatever you want with that. By offering to lower your purchase APR with your rewards, just shows that they go above and beyond the call of duty. The rates on this card are good, and compares with similar card. Let Bank of America and Visa reward you for being a loyal customer. Apply today and watch the rewards start rolling in!

Additional Resources:

Trey Knox

Team Your Credit Network

New to Your Credit Network is the Visa Signature WorldPoints Rewards Card from Bank of America. In this blog entry we will cover the basics, dissect its reward program and see how it stacks up to other cards.

Bank of America WorldPoints Rewards Basics

- 0% Introductory Rate for 12 months

- 7.9% fixed APR

- No annual fee

- Point based rewards system

BofA World Points Rewards Program

The WorldPoints Rewards card has a very competitive and decent rewards program. It is a point based rewards system that rewards you one point for every dollar you spend on qualifying purchases. These points can be redeemed in the form of brand name merchandise, gift certificates, cash rebates and travel rebates. There is not a cap on the amount of points you can earn in a year, but unused points will expire after five years. This rewards program actually rewards you for your business.

The World Points Rewards card also has a very generous benefit program to compliment the rewards program. BoA's benefits include the My Concierge program. MyConcierge can help you to obtain information on dining and personal services, as well as tickets to concerts, sporting events and theater.

B of A WorldPoints Rewards Card Stacks Up to the Competition

The World Points Rewards card is for those with very good credit who can take advantage of the excellent rewards program that it offers. Its lack of an annual fee or introductory rate is a testament to the fact that the card was designed for those with solid credit ratings. Along with BofA's reasonable APR the card's rewards program is pretty fair and comparable to many of the other cards out there designed for people with good credit. The Bank of Amercia World Points Rewards Card from FIA Card Services, N.A is an excellent choice to those with good credit who want to take advantage of a good rewards program and receive good benefits.

Additional Resources:

Amanda Robbins

Team Your Credit Network

|