Today we’re taking a break from the usual facts and figures offered up by the Your Credit Network Blog to answer some of the fun credit card trivia questions that have been rolling in. Here are the top three that we received in January:

Why Are Credit Cards All The Same Size?

Credit cards are all regulated to meet the same ISO 7810 standard, which is also the same standard used for identification cards (such as your driver’s license) around the world. ISO stands for the International Organization for Standardization – a multinational association responsible for settings standards for any number of products that you use every day. This makes sense if you think about it… how else would ATMs or merchants in Canada, the United Kingdom, or any other country be able to accept your credit card if you traveled abroad?

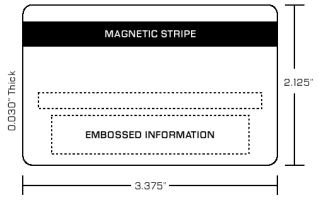

Credit cards are 3.375 inches wide by 2.125 inches tall, with an average width of 0.76mm (or 0.02 inches). This size was supposedly established by Bank of America in the 1950s with the introduction of the “Bank of Americard†credit card; this credit product would later evolve into the Visa network as we know it today.

What Information is Contained in the Magnetic Credit Card Strip?

The magnetic credit card strip contains three sets of data, also known as tracks, which contain information about you and your credit card.

Track one contains the most detail about you and your card because this track can hold up to 210 bits of information per inch; as such, it is also the only track that may contain letters of the alphabet. It is also the most sensitive of the three tracks, which means it can be easily damaged by magnetic fields or normal wear & tear.

Some of the fields on this track include:

- Primary account number (not to exceed 19 numbers)

- Name (not to exceed 26 characters)

- Expiry/expiration date (4 characters)

- Extra data, such as your Personal Identification Number (also known as PVV, or the Personal Verification Value)

Track two contains the most basic set of information needed to process a credit card transaction and may only hold 75 bits of information per inch. This track allows for basic processing of credit card transactions in the event that the first track is too corrupt to process.

Track three is the oldest of the tracks and is not used for the most part. Most of the major credit card issuers do not even issue credit cards with this track in order to reduce the size of the magnetic strip that is present on their credit card products.

How Do They Pick Credit Card Numbers?

Credit card numbers are determined using a sequence called the Luhn algorithm, which doubles every other number in a credit card’s sequence and then takes the sum of all numbers and divides that by ten. If the resulting product is a whole number, then the credit card number used is valid; otherwise, the credit card number is not valid. The final digit of a credit card is used as a checksum to provide additional security to the Luhn sequence – this ensures that all attempts to fabricate a credit card number have a 10% chance of working from the get-go.

The first six digits of a credit card number determine which of the major credit card networks issued the card in question.

- Visa credit cards begin with 4xxxxx.

- MasterCard credit cards begin with 51xxxx, 52xxxx, 53xxxx, 54xxxx or 55xxxx.

- American Express credit cards begin with 34xxxx or 37xxxx.

- Novus/Discover credit cards begin with 6011xx.

Additional Resources:

Kimberly Carte

Team Your Credit Network