This card has amazing rewards for people with good to very good credit. If you continually make purchases and pay your monthly bill on time, this card is definitely one of the best choices out there for a credit card rewards program.

Discover the Motiva Credit Card Rewards Program

If you spend up to $1,500 during one billing cycle, you will receive a .25% rebate; if you spend even more, you receive larger percentages in cash back form. For instance, spending between $1,500 and $3,000 will get you a return of .5%, and over that you will receive a 1% rebate. Discover also gives you an additional .25% return if you spend money at select discount stores and warehouse clubs as well. Sound too good to be true? Wait until you read about the other great bonuses.

If you like shopping online, then you're in luck. Make any purchase on Discover's exclusive online shopping site, and you are eligible to receive 5% to 20% cash back. If you don't take advantage of this money right away, you can rest assured that any points or cash back rbates you earn do not expire as long as the card is active, and there is no limit to how much you can earn in total rebate value.

Motiva's On-Time Payment Bonus

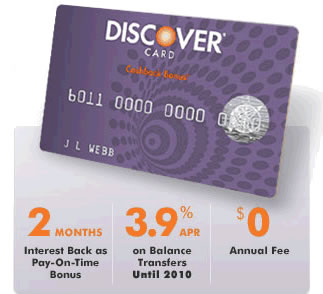

If you pay on time, you can receive Discover's "pay-on-time" bonus. What this means is that when you do pay your monthly bill on time for six months straight, you will be given some credit to go toward the next months interest - the offer extends through the lifetime of your account, so you may continue to take advantage of this unique reward type every time you pay your bill.

The introductory APR is a mere 3.9% for the first ten months, and this applies to balance transfers as well. After these ten months, the APR is relatively low for those who qualify for the card, so make sure your credit score is right where you'd like it to be before you apply for the Discover Motiva Credit Card.

There is a whole host of other fantastic services that accompany this credit card, including auto rental insurance, fraud protection, $500,000 in flight insurance, and more. See the complete Discover Motiva Card review for more information about these benefits.

Additional Resources:

Amanda Robbins

Your Credit Network Contributor