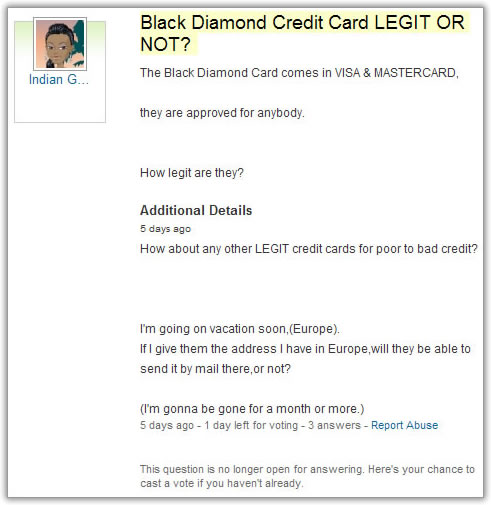

Greetings Your Credit Network readers! Every now and then I dive into Yahoo! Answers and try to field some of the tough credit questions that people just like you have about all the credit card deals out there. I took a day or two to research my answer for one of the questions I saw, but wouldn't you know it - they closed the topic for new answers! No biggie... here's a copy of the question as seen on the original Yahoo! Answers request as well as the response I would have posted had I acted a little bit faster!

It sounds like you have a couple of questions here, so let me try to answer them one at a time!

Is The Black Diamond Credit Card Legitimate?

Yes. The New Millennium Black Diamond credit card is issued by New Millennium Bank, which is one of the more popular credit card issuers for people who have less than perfect credit. Most online credit card resource sites have been carrying the card since early February of 2007, and the popularity of this program has been met with mixed reviews; of the credit cards that do come from New Millennium Bank (there are three total), the Black Diamond edition is by far the most popular – followed by the Gold series and then the Platinum series. The reason for the higher marks is the lower application/processing fees that are associated with the New Millennium Black Diamond card (the other two programs have slightly higher deposits that tend to discourage people who are not serious about getting a credit card from applying.)

What Other Credit Cards Are There For People With Bad Credit?

It’s good to see that you are exploring your options! One of the best kept secrets of online credit is that bad credit credit cards actually have more variety than do those that are targeted for people with excellent credit. Credit cards for people with poor credit actually exist on a sort of tiered system, meaning people with bad credit can actually get decent rates compare to people with REALLY bad credit, who generally pay way more than they should in interest expense than they would if they just took a few months to improve their credit score and then applied for a card.

Confused? Don’t be! The trick is to consider your credit history and how often you missed payments and/or defaulted on loans of any kind. If your answer is yes and relatively recently, then you’re better off applying for a lower tier card since you are unlikely to qualify for the more primo bad credit credit cards; if you have been doing well at paying your bills on time or you defaulted on a card but it was a long time ago (2+ years) then you should go for the top tier credit cards – you’ll probably be happier with them.

You Still Didn’t Answer My Question… What Other Credit Cards Are There!?

Good catch. It’s important that I got you thinking about your credit situation before I present your alternatives. Here are some other credit cards for you to consider if you find that the New Millennium Black Diamond isn’t for you (I picked the top performers from each bank, though there are more if you keep looking):

Orchard Bank Platinum MasterCard

Issued by HSBC Bank

This credit card trails slightly behind the Continental Finance Gold, likely because the interest rates are slightly higher. If you choose not to get the Black Diamond card and you find that the Continental Finance isn’t for you, then this is an excellent choice.

Access Visa Card

Issued by Plains Commerce Bank

This is a great credit card if you find your applications are rejected elsewhere. The interest rates are a bit high (19%+) but if you really need a credit card for your travels, this is a viable option.

Which One Should I Apply For?

Only you can make the best decision for your unique financial situation – read up on each card and see which one fits your lifestyle best!

What About Shipping A Card To Europe?

I would advise against this completely. Not only will the credit card issuer probably object to an out-of-country shipping arrangement, on the off chance they were to say yes you have fewer ways to pursue financial relief if something were to happen to the card (i.e. lost or stolen en route to your vacation spot.) You might consider applying for the card of your choice while at home, and then having a friend or relative ship you the physical card via a private carrier like FedEx when it arrives at your home address. Not only will this speed up your receipt of the card, it will also give you peace of mind that your credit card is in the right hands at all times.

I hope you find this information useful – good luck!