- 10.99% regular APR (fixed)

- Rebate rewards program

- Earn 1% cash back on all other purchases

The Discover More Card is perfect for those with very good credit who are looking for a cash rewards credit card. With the Discover More Card, you can earn up to 5% cash back on purchases. In this post, we'll review the basics of the card and highlight its best features.

Discover More Rewards Program

Through the Discover more cash rewards program, cardholders earn a 5% cash back bonus in categories like gas, home, travel, movies, restaurants, and more. For all other purchases, cardholders earn a 1% cash back bonus. If you apply now, you will also receive a $40 cash back bonus. When you redeem your rebates for gift certificates from Discover partners, you will receive up to double cash back bonuses. The Discover More card has no limits on the amount of rebates you can earn in a year, and your rebates will never expire as long as your account is active within the last 36 months.

Additional Benefits

The Discover More card has many other attractive benefits in addition to the rewards program. For one, the card comes in many unique designs, including clear, sealife collection, wildlife collection, and American flag. For the first six months, the card offers a 0% APR on purchases. You will also enjoy a 0% APR on balance transfers for the first 12 months. The regular APR is a competitive, fixed rate of 10.99%. Cardholders will receive several platinum benefits, including auto rental insurance, travel accident insurance of up to $500,000, and a variety of fraud and security protection services. Additionally, certain participating retailers and merchants offer discounts to Discover More cardholders. Thus, if you have good credit and spend over $3,000 per year (to qualify for the cash rebate), the Discover More card is an excellent option.

Additional Resources:

Would you like a credit card that reflects your personality? How about a great cash reward program, too? The Discover More Card – Monogram can offer you both. In this post, we’ll give you the basics of the Discover More Card – Monogram and explain why it’s a step above other cards.

The Basics: Discover More Card – Monogram

- 0% introductory APR on balance transfers and purchases

- Intro APR lasts for 12 months

- 10.99% regular APR, fixed

- No annual fee

- Cash rebate rewards program

- Platinum card benefits

- Up to 5% Cashback Bonus

- Rebates have no limits, no expiration dates

Discover More Card – Monogram: The Reward Program

The Discover More Card – Monogram is perfect for those with very good credit who would like a personalized card design and an amazing cash rebate rewards program. Through the reward program, you will earn a 5% cash rebate on purchases in select categories that will change four times per year. Travel, gas, home, movies, and restaurants are a few examples of these 5% rebate categories. For all other purchases, you will earn a 1% Cashback Bonus. As an additional perk, you will earn a $40 cash rebate bonus if you spend $500 in the first three months you are a cardholder. You can receive up to double cash bonuses if you redeem your rebates for gift certificates at certain Discover Card partners. You will also enjoy no limit on the amount of rebates you can earn, and your rebates will never expire as long as your account is active within 36 months.

More Card Features

The major feature that sets the Discover More Card – Monogram apart from its competition is the customized card design. You will be able to select from several card designs, which will display your initial(s) on the front of the card. The Discover More Card – Monogram comes with an unbeatable 0% introductory APR offer for the first 12 months. Afterwards, you will enjoy a low 10.99% fixed APR, which means you will have the security of a consistent APR. Additionally, you will receive platinum cardholder benefits, such as auto rental insurance, $500,000 in travel accident insurance, and fraud and security protection services.

Additional Resources:

Business owners in the market for a credit card that allows them to earn cash-back rewards will not need to look any further than the Discover Business Card. This card combines the appeal of 0% introductory interest rate cards with the utility of a cash rewards program. In this post, learn more about the Discover Business Card and how it sets itself apart from the competition.

Discover Business Card: The Basics

- 0% introductory APR for the first year

- 13.99% regular APR

- No annual fee

- Cash rebate rewards program

- Fixed rate APR

Excellent Card Combined with Cash Rebates

The Business Discover Card combines the attractiveness of a low-interest rate card with the incentive of cash rebates. For business owners with very good credit, this card has it all. With the reward program, you will earn 5% cash back on your first $2,000 in office supply purchases, 2% on your first $2,000 in gas purchases, 0.25% for purchases made at certain warehouse clubs and discount stores, and up to 1% for all other purchases. If you wish to double your Cashback Bonus dollars, you can redeem your rebates for Discover Card Partner gift certificates. To sweeten the deal even further, there is no limit to your cash rebates and the rebates never expire, as long as the card is active within a 3-year period.

More to Offer than Just Cash Rebates

What sets the Discover Business Card apart from its competition is that its benefits do not stop at an unbeatable cash rewards program. The card also offers a 12-month, 0% introductory APR on purchases and balance transfers. After the introductory period expires, the rate remains reasonable at 13.99%. As a Discover Business Card cardholder, you will also enjoy discounts at select retailers. In addition, Discover offers its cardholders an array of useful services, including access to PurchaseChecks and fraud and security protection.

If you are a business owner interested in getting a low-interest credit card that will earn you cash rewards, the Discover Business Card is the perfect match for you.

Additional Resources:

A highly recommended card on Your Credit Network is the Miles Card from Discover. This blog entry will cover the basics, and the benefits that Discover Miles Card offers.

Miles Card From Discover Card Basics

- No annual fee

- 10.99% Variable APR

- 0% introductory rate for the first 12 billing cycles on balance transfers and purchases

- Miles Rewards

Miles Credit Card From Discover Benefits

This card is designed for those who have very good credit, and looking for great rewards to acquire during their purchasing. This card has rewards specific to airline travel. Rewards are done in the form of earning miles. You earn 1 mile for every dollar spent with the card. The rewards include:

- Cardholders earn 1000 bonus miles a month for the first year, if you make a purchase during that month.

- No blackouts on earned airfare

- Earn up to double miles on $3000 in travel and restaurant expenses

- No expiration date on miles

- Auto rental insurance, and travel accident insurance

These great rewards have no expiration date, and all you have to do is make sure your account does not go inactive for more than 36 months. At that time you run the risk of losing points, but you get the card to use it, so it should not become a major concern. There is also an annual limit of 60,000 points. Even though there is a limit that is still a big amount of points that you can earn towards great travel rewards.

Have Fun With The Miles By Discover Credit Card

So as you can see this Miles Card from Dicsover is a hit. It gives you great travel rewards that are easy to use. These are not just some rewards for airlines no one has ever heard of. These are rewards for major U.S. airlines. Combine those rewards with great rates, and this card cannot be beat. They want you to be rewarded for using this card and will not make it hard to do so. So apply today and let the fun begin. You will not be disappointed.

Additional Resources:

Amanda Robbins

Team Your Credit Network

The latest addition to Your Credit Network is the Discover Business Miles Card issued by Discover/Morgan Stanley. This blog will examine the card's great features and give you insight on what it means to have a stellar business miles card from Discover.

Discovering What the Discover Business Miles Card has to Offer

Are you always on the go for business trips? If so, you need a credit card that can start giving back. The Discover Business Miles Card is designed for those with very good credit who plan to take advantage of the travel reward program. Why should you dish out endless amounts of money for your business-related travel only to get nothing in return? Well now you can! Discover has put together a perfect reward program allowing cardholders the ability to earn double miles on up to $5,000 in travel and gas purchases; they also give one mile for every dollar spent on general purchases. Redeeming your miles is easy and they can be used toward airfare or reduced airfare on most major U.S. based airlines. Cardholders also have the ability to redeem miles for gift cards from 50 brand-name partners. A great feature is that there is no limit to the amount of points a cardholder can earn and points do not expire, which is not commonplace with most business credit cards currently on the market.

Attractive features of the Discover Business Miles Credit Card

- Introductory Rate: 0.00%

- Annual Fee: $0

- Balance Transfer Fee: None

- Additional Miles: Earn double miles on up to $5,000 in travel and gas purchases.

The Perks of having a Business Miles Credit Card

Everyone wants a great rewards program, so why shouldn’t you have a great business card that is going to give back great deals specifically designed for the modern executive on the go? Now you can have just that! Traveling for business can be very expensive, and what's worse is there is no easy way to get around it. Having a card that can give back to you really can help you out and save you a pretty penny over time. In addition to airline bonuses and cash savings, here are a few perks that this business cash card has to offer:

- 30% Off + Six 1/4 Pound Steak Burgers Free from Omaha Steaks

- Up to 20% Off Purchases at Lenovo

- 20% Off Your Floral Order at FTD.com

See the Discover Business Miles Card for additional perks this card offers.

Additional Resources:

Jay Dobbins

Your Credit Network

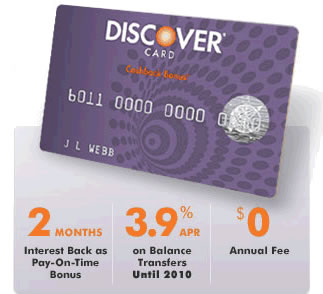

This card has amazing rewards for people with good to very good credit. If you continually make purchases and pay your monthly bill on time, this card is definitely one of the best choices out there for a credit card rewards program.

Discover the Motiva Credit Card Rewards Program

If you spend up to $1,500 during one billing cycle, you will receive a .25% rebate; if you spend even more, you receive larger percentages in cash back form. For instance, spending between $1,500 and $3,000 will get you a return of .5%, and over that you will receive a 1% rebate. Discover also gives you an additional .25% return if you spend money at select discount stores and warehouse clubs as well. Sound too good to be true? Wait until you read about the other great bonuses.

If you like shopping online, then you're in luck. Make any purchase on Discover's exclusive online shopping site, and you are eligible to receive 5% to 20% cash back. If you don't take advantage of this money right away, you can rest assured that any points or cash back rbates you earn do not expire as long as the card is active, and there is no limit to how much you can earn in total rebate value.

Motiva's On-Time Payment Bonus

If you pay on time, you can receive Discover's "pay-on-time" bonus. What this means is that when you do pay your monthly bill on time for six months straight, you will be given some credit to go toward the next months interest - the offer extends through the lifetime of your account, so you may continue to take advantage of this unique reward type every time you pay your bill.

The introductory APR is a mere 3.9% for the first ten months, and this applies to balance transfers as well. After these ten months, the APR is relatively low for those who qualify for the card, so make sure your credit score is right where you'd like it to be before you apply for the Discover Motiva Credit Card.

There is a whole host of other fantastic services that accompany this credit card, including auto rental insurance, fraud protection, $500,000 in flight insurance, and more. See the complete Discover Motiva Card review for more information about these benefits.

Additional Resources:

Amanda Robbins

Your Credit Network Contributor

Your Credit Network is proud to announce the addition of the Student Monogram Credit Card issued by Discover – the latest in our line of student credit cards. This blog entry will cover the basics of this credit card, as well as some comparisons to other credit cards in the student category.

Credit Card Basics

As with most credit cards issued by Discover, the fees and rates are very straightforward:

Introductory Rate: 0% APR on all purchases for six months (this does not include balance transfers)

Regular APR: 16.99%, computed on a two cycles average daily balance method

Annual Fee: This card carries no annual fee.

Additional Fees/Costs: This credit card has no additional fees or costs.

Rewards Program: This is a student credit card with cash back rewards.

Student Credit Card with Cash Back Rewards

One of the most attractive features of this credit card is its cash back rewards program, which offers a variety of tiers for students to receive cash back rewards. Unlike most student credit cards which average 2%, the maximum possible rebate that can be earned while using the Discover Student Monogram Credit Card is 5%; in order to get this rate you must make your purchase at participating vendors, but Discover makes this easy by providing you a list based off of your geographic region.

Tip: After getting your first credit card statement or welcome package, visit the website address provided and map out participating stores so you can earn back the maximum amount of cash rebates!

For all other purchases you will earn a maximum of 1% cash back regardless of where you shop, though it is important to note that you must spend at least $3,000 per year to get this rate (the average student spends about $3,800 per year according to the Senate Banking Committee’s Report on College Student Credit Card Usage); if you fall short of that rate you will still get cash rebates, but on a slightly reduced scale (see the full credit card review for more details).

The cash back bonuses are paid out via cash vouchers (or coupons) on a per-month basis, though you do have the opportunity to double your bonuses if you spend them with select retailers. This means you have the potential to get up to 10% cash back just by using the Discover Student Monogram Credit Card – an offer that is not available through other credit cards in the student credit card category. The vouchers never expire and there is no limit to how much you can earn during a 1-year period, so the sky’s the limit with the Student Monogram Credit Card’s cash back program!

Discover Student Monogram Credit Card vs. Other Student Credit Cards

The Student Monogram Credit Card’s interest rate is actually lower than the average interest rates of similar credit cards in the student credit card category. All other student credit products from Discover do offer the same interest rate and reward program, so if you’re interested in a Discover student credit card then the only real difference is how the card looks (i.e. pictures of wildlife, beaches, monogram, etc.)

The Discover Student Monogram Card is the only student credit card that allows you to customize how the card looks with your initials. When you sign up for the card you may pick from one of three designs and either a first/last initial (mine would be KC) or just a first initial (mine would be K) on the background of the credit card. This is the most distinct feature of this card and is one of the reasons it is incredibly popular!

Additional Resources:

Kimberly Carte

Your Credit Network

|