- No introductory rates

- Variable APR

- $300 up to $10,000 limit

Alright here’s the situation, your credit is poor, you have a large purchase you’re looking to finance, but have no way to pay for it! Well take a look at this. It’s the Bank of America Secured Visa Platinum card. That’s right a secured, platinum card offered strictly for those with poor credit scores. Many people run into the problem of acquiring a unsecured credit card when their credit score has dropped, with the help of this credit card you can get your finances back on track.

Reasonable Pricing

Although this program is a secured credit card the used is still offered many rewarding benefits. For instance, the card comes with a $29 first year fee, which is quite reasonable for a secured credit card. The card also comes with Bank of America’s Free Total Security Protection offer and free, award winning, online banking. That’s not all the program even offers you the chance to personalize the card with Photo Expressions.

Poor Credit Applicants

Applying for a credit card with poor credit can be quite difficult, until now. If you are ready to start building your credit score and want to do it in an inexpensive manner we suggest the Bank of America Secured Visa Platinum card. With a credit limit from $300 up to $10,000 and no introductory rates it is clear to see why this card is so popular.

Additional Resources:

- 0% APR on purchases and balance transfers for 12 months

- 17.49% regular APR

- Earn two miles for every dollar spent on travel purchases

- No blackout dates or seat restrictions

If you would like to earn free hotel stays, airline travel, and car rentals by using your credit card, the Chase TravelPlus Visa Card is perfect for you. The Chase TravelPlus Visa Card offers all the benefits of a traditional credit card in addition to an unbeatable travel reward program. In this post, we’ll explain the basics of the card and what makes it stand out among the competition.

Travel Reward Program

The Chase TravelPlus Visa Card offers one of the industry’s best travel reward programs. Through the program, you will earn two miles for every dollar you spend on travel purchases and one mile for every dollar you spend on general purchases. You can redeem these miles for free airline travel, car rentals, hotel stays, retail gift certificates, and more. There are no limits on the amount of miles you can earn. The Chase TravelPlus Visa Card reward program also has no blackout dates or seat restrictions.

Other Card Benefits

In addition to the terrific travel reward program, the Chase TravelPlus Visa Card also offers a plethora of cardholder benefits. Such benefits include up to $1,000,000 in travel accident insurance, travel and emergency assistance services, and auto rental insurance. You will also enjoy an attractive 0% APR on purchases and balance transfers for the first 12 months you are a cardholder. The APR after the introductory offer is reasonable for a travel reward card. Though the card itself has no annual fee, you must pay a $29 annual fee to participate in the rewards program. This fee is exceptionally low when compared with those of other travel reward cards.

Additional Resources:

- 1.99% APR on balance transfers for 12 months

- 9.99% regular APR (fixed)

- Credit line as high as $250,000

- 1% cash back on almost all purchases

If you have very good credit and would like a credit card with a cash-back rewards program, you should consider the Total Merrill Cash Back Visa card. The Total Merrill Cash Back Visa gives customers the choice of receiving cash back or having deposits made automatically to a Merrill Lynch account. In this post, we’ll explain the basics of the Total Merrill Visa and what makes it stand out among the competition.

Total Merrill Cash Rebate Program

Through the Total Merrill Cash Back Visa card reward program, cardholders earn one credit for every dollar spent on almost all purchases. As your credits accumulate, you have the option of receiving a cash reward check or having the credits deposited directly into your Merrill Lynch Cash Management Account or Beyond Banking account after you earn 5,000 credits. There are no limits on the number of credits you can earn. However, cash reward checks expire 90 days after they are issued.

Other Card Benefits

The Total Merrill Cash Back Visa also comes with an attractive 1.99% APR on balance transfers for the first 12 months. This rate also applies to cash advances during the first 12 months. The regular APR is a fixed, competitive rate of 9.99%. The low purchase APR will save cardholders who carry a balance a substantial amount of money on interest. Thus, if you have very good credit, intend to take advantage of the cash rebate program, and occasionally carry a balance, the Total Merrill Cash Back Visa card is an excellent choice.

Additional Resources:

- 0% APR on purchases & balance transfers for six months

- 14.49% regular APR (variable)

- Earn four reward points for every dollar spent at Pier 1

- One point per dollar on other purchases

Do you shop frequently at Pier 1? Would you like a credit card with competitive rates and a great rewards program? If so, the Pier 1 Rewards MasterCard is the card for you. In this post, we’ll cover the basics of the Pier 1 MasterCard and tell you what makes it unique.

The Rewards Program

With the Pier 1 Rewards MasterCard, you can earn four points for every dollar you spend on purchases at Pier 1. For other purchases, you will earn one point for every dollar spent. Once you earn 2,000 points, you will be issued a $20 rewards certificate for use on purchases at Pier 1 Imports. You will also receive a 20% off coupon with your reward certificate. You can earn up to 40,000 rewards points annually, and reward certificates expire after 90 days. Therefore, this card is ideal for those who shop frequently at Pier 1 Imports, as they will earn additional rewards points for their purchases.

Other Cardholder Benefits

The Pier 1 Rewards MasterCard comes with a very attractive 0% introductory APR on purchases and balance transfers for six months. The card comes with a reasonable 14.49% regular variable APR. Cardholders can also access and manage their accounts for free online. Pier 1 Rewards MasterCard holders enjoy members-only savings and discounts at Pier 1 all year long. This card is a great option for those who have very good credit, plan to take advantage of the introductory offers, and shop frequently at Pier 1.

Additional Resources:

- 0% introductory APR for 12 months on balance transfers

- 9.99% regular APR (fixed)

- No annual fee

- Earn EarthSmart points for every dollar

Did you know you can help protect the environment just by using your credit card? With the Brighter Planet Visa credit card, you can do just that. In this post, we’ll cover the basics of the Brighter Planet Visa and explain what makes it unique.

Go Green with Your Credit Card

The Brighter Planet Visa credit card offers one of the most unique rewards programs in the business. With every dollar you spend on purchases, you will earn one EarthSmart point. These points will be automatically redeemed to help fund renewable energy projects. After your first purchase, you will earn 1,000 bonus EarthSmart points. You also receive 1,000 bonus points for signing up for paperless billing. Additionally, until December of 2008, Bank of America will make a matching contribution of one additional point for every two points earned by a cardholder. The company estimates that every 1,000 points cardholders earn will pay for about one ton of carbon offsets. Thus, this card is ideal for consumers who want to support an organization that helps protect and monitor the environment.

Added Benefits

The advantages of the Brighter Planet Visa credit card extend far beyond the rewards program. For one, the card comes with an unbeatable, 12-month introductory 0% offer on balance transfers. The regular APR is a competitive 9.99% and fixed, which means you will not have to deal with wild fluctuations in your interest rate. Cardholders also have the option to create a profile on the Brighter Planet website, which allows them to track their impact on the environment. The Brighter Planet Visa also offers traditional cardholder benefits, such as online account access, fraud protection, and mini card service. You receive all of these benefits for no annual fee.

Additional Resources:

Would you like a credit card that reflects your personality? How about a great cash reward program, too? The Discover More Card – Monogram can offer you both. In this post, we’ll give you the basics of the Discover More Card – Monogram and explain why it’s a step above other cards.

The Basics: Discover More Card – Monogram

- 0% introductory APR on balance transfers and purchases

- Intro APR lasts for 12 months

- 10.99% regular APR, fixed

- No annual fee

- Cash rebate rewards program

- Platinum card benefits

- Up to 5% Cashback Bonus

- Rebates have no limits, no expiration dates

Discover More Card – Monogram: The Reward Program

The Discover More Card – Monogram is perfect for those with very good credit who would like a personalized card design and an amazing cash rebate rewards program. Through the reward program, you will earn a 5% cash rebate on purchases in select categories that will change four times per year. Travel, gas, home, movies, and restaurants are a few examples of these 5% rebate categories. For all other purchases, you will earn a 1% Cashback Bonus. As an additional perk, you will earn a $40 cash rebate bonus if you spend $500 in the first three months you are a cardholder. You can receive up to double cash bonuses if you redeem your rebates for gift certificates at certain Discover Card partners. You will also enjoy no limit on the amount of rebates you can earn, and your rebates will never expire as long as your account is active within 36 months.

More Card Features

The major feature that sets the Discover More Card – Monogram apart from its competition is the customized card design. You will be able to select from several card designs, which will display your initial(s) on the front of the card. The Discover More Card – Monogram comes with an unbeatable 0% introductory APR offer for the first 12 months. Afterwards, you will enjoy a low 10.99% fixed APR, which means you will have the security of a consistent APR. Additionally, you will receive platinum cardholder benefits, such as auto rental insurance, $500,000 in travel accident insurance, and fraud and security protection services.

Additional Resources:

Go green with the GE Money Earth Rewards MasterCard. You can help clean up the environment just by using your GE Money Earth Rewards card. Not to mention you will also get a great credit card with competitive terms and rates. In this post, we will cover the basics of the GE Money Earth Rewards MasterCard and explain what makes it unique.

Quick Facts about the GE Money Earth Rewards MasterCard

- 0% introductory rate on purchases for six months

- 12.99% regular APR (variable)

- $0 annual fee

- No application fee

- Rebate rewards program

- Rebates automatically contributed to emission reduction programs

- Option of receiving part cash rebate, part donation

- 1% rebate on all purchases

Money Earth Rewards Program

Through the GE Money Earth Rewards program, cardholders can earn rebates that will be automatically contributed to emission reduction projects. You will earn a 1% rebate on all of your purchases, and this rebate will be donated to emission reduction programs. Such programs work to reduce greenhouse gas emissions. You also have the option of donating a 0.5% rebate to emission reduction and receiving the other 0.5% in cash rebates in your monthly statement. If you are environmentally-conscious, the GE Money Earth Rewards MasterCard is ideal.

Other Benefits

The GE Money Earth Rewards MasterCard has much to offer beyond the rebate program. In addition to helping reduce emissions, your card will also come with a 0% APR on purchases for the first six months. After that, your APR will be a competitively low 12.99% variable rate. Your regular APR will be based on the highest Prime Rate over a three-month period. With the GE Money Earth Rewards MasterCard, you will also enjoy free Internet account management services, zero liability for unauthorized transactions, and stolen/lost card reporting.

Additional Resources:

Would you like the convenience of a credit card without the risk? Are you unable to qualify for an unsecured card? If this sounds like you, the Millennium Advantage Pre-Paid MasterCard is ideal for your situation. In this post, we’ll give you some basic information about the Millennium Advantage Pre-Paid MasterCard and explain what makes it unique.

Millennium Advantage Pre-Paid MasterCard Basics

- No annual fee

- $99 application fee

- Convenience of a credit card without risk of overspending

- $5.95 monthly participation fee

- $1.00 reloading fee

- Inactivity fee after 60 days

- Easy to qualify for

About the Millennium Advantage Pre-Paid MasterCard

If you have difficulty qualifying for an unsecured card because of credit challenges, you will want to consider the Millennium Advantage Pre-Paid MasterCard. This is a stored value card designed specifically for people who do not qualify for other types of cards. You will enjoy all the conveniences of a credit card without any risk of going into debt. You make your payments in advance, and these payments represent your spending limit. You can load your card via online account transfers, mailed payments, or at loading stations at authorized partner locations. Every time you reload, you will pay a $1 fee.

Fees and Other Information

When you apply for the Millennium Advantage Pre-Paid MasterCard, you will pay a one-time $99 activation fee. There is also a low $5.95 monthly participation fee for the convenience of the card. The inactivity fee only applies if you do not use your card for 60 days. In the first year, you will pay at least $170.40 in fees. It is important to note that this card does not report activity to the credit bureaus, which means it will not have an impact on your credit. This is mainly a concern for people who are looking for a card to rebuild bad credit.

Apply for the MasterCard Millennium Advantage Pre-Paid card

Additional Resources:

In the market for a credit card? If you have very good credit and are looking for a card with cash-back rewards and rock-bottom interest rates, you need look no further. The Citi CashReturns MasterCard gives you the best of both worlds—excellent rates with an unbeatable cash back rewards program. In this post, we’ll cover the basics of the Citi Cash Returns MasterCard and explain how it pummels the competition.

Citi CashReturns Master Card: Basic Info

- 0% introductory APR on balance transfers

- Intro APR lasts 12 months

- 10.99% regular APR, variable

- No annual fee

- Issued by Citibank

- Cash back rebate program

- Earn rebates on purchases, cash advances, & balance transfers

The Citi CashReturns MasterCard Rewards Program

The Citi CashReturns card’s free rewards program is one of the best of its kind. Through the program, you can earn a 5% cash-back rebate on your purchases for the first 90 days. After the first 90 days, you will earn a 1% rebate on purchases and cash advances. The rewards program also extends to balance transfers. For every $1500 individual balance transfer transaction, you will earn five CitiDollars. Every time you earn $50 CitiDollars, you will automatically be issued a check for $50. Checks will not be issued for less than $50.

Other Card Benefits

For no annual fee, the Citi CashReturns MasterCard offers an unbeatable 0% intro APR on balance transfers and a low APR on purchases. The rate is variable, which means it is tied to the Prime Rate published in the Wall Street Journal. Keep in mind that the cash advance APR comes with a minimum cap, so it will not fall below the cap even if the Prime Rate does. Citibank protects its CashReturns MasterCard cardholders by giving zero liability on unauthorized purchases, emergency and travel assistance, auto rental insurance, and annual account summaries. You will also enjoy identity theft solutions services, as well as fraud and security protections.

Apply for your Citi CashReturns MasterCard here and start earning cash back today!

Additional Resources:

Do you visit Wawa convenience stores and gas stations frequently? Would you like to save money on gas with your credit card? If so, the Chase Wawa Visa Card is the right card for you. The Wawa Visa credit card gives you rebates on your purchases at Wawa gas stations and other businesses so you can earn back some of the money you spend. This post explains the fundamentals of the Wawa Visa Card and why it is the best of its kind.

Wawa Visa Card from Chase: The Basics

- 0% introductory APR for six months

- Intro APR applies to balance transfers

- 15.24% variable regular APR

- No annual fee

- For those with average and above credit

- Earn up to 10% rebates on Wawa purchases

Wawa Visa Rewards: How It Works

The Wawa Visa Card is designed for people with average credit who frequent Wawa conveniences stores and gas stations, use their cards often, and intend to take advantage of the rewards program. Wawa Visa rewards are offered in the form of a rebate program. In the first 90 days, you earn a 10% rebate on Wawa purchases and a 2% rebate on other purchases. After the first 90 days, you earn a 4% on your Wawa purchases and 1% on other purchases. If you buy gas at Wawa frequently, the Wawa Visa is a great way to cut your fuel costs.

A Rewards Card and More

In addition to an unbeatable rebate rewards program, the Chase Wawa Visa Card offers many other features for cardholders. You will have access to travel accident insurance, online account management, auto rental insurance, and purchase protection, to name a few. The Wawa Visa also looks out for its cardholders with zero liability on unauthorized transactions and emergency cash/card replacement services. On top of these perks, you will enjoy an attractive 0% balance transfer APR for the first six months and, for those who qualify, a purchase APR as low as 6.99%. This card offers these features with reasonable APR’s for no annual fee.

Start earning Wawa rebates now…apply for a Wawa Visa Card today!

Additional Resources:

Do you work hard to keep your credit rating above average? Do you want the lowest possible interest rate you can get? Well, you’re in luck - the Capital One Platinum Prestige Credit Card is just that. This is a new card to Your Credit Network and we want you to take advantage of it. This post will cover the basics of this platinum card and how this incredible card is the best you can get.

Capital One Platinum Prestige: Credit Card Basics

- $0 annual fee

- 7.4% Variable APR (the lowest APR of any credit card available)

- No application or participation fees

- Designed for those who have very good to excellent credit

Click here to view the full details of the Platinum Prestige Card from Capital One

The Lowest of the Low Interest Credit Cards

You read right: 7.89% APR. You would be hard pressed to find a card with a lower interest rate, simply because it doesn’t exist. This is why the card is perfect for things like balance transfers and even carrying large balances from time to time. Capital One wants you to be able to use this card for anything you want, and for the lowest APR possible.

No fees. None. Zip. Zilch. Nada. Combine that with very low interest and you have the perfect credit card. You have great credit, and it is important to cash in on that. This is one of the most cost effective credit cards that you will be able to get a hold of. Who wouldn’t want it?

One of the Best Credit Cards Around

You deserve the cream of the crop, and Capitol One Bank will give you just that. While this credit card does not have a rewards program, it’s clear that the true reward is the lowest interest rate available by any card anywhere. Period. It’s that simple.

Click here to apply for the Capital One Platinum Prestige Credit Card

Additional Resources:

If you have credit troubles in the past you are probably looking for a great way to get back on the right track. Your Credit Network is proud to announce the Standard Platinum Card from Capital One Bank – a credit card specially designed for people who are working hard to rebuild their credit profile. This post will cover the basics of this card and how Capital One will help you work yourself back into a good credit bracket.

Capital One Standard Platinum: Credit Card Basics

- $19 annual fee

- 14.89% Variable APR

- No application or participation fees

- For those who have credit problems but are working to raise their credit score

Click here to view the complete basics of the Capital One Standard Platinum Card

Stability and Peace of Mind Come Standard

If you have credit troubles then you probably just expect credit cards to come with high interest rates and numerous fees - but the Capital One Standard Platinum breaks away from that trend. There are no monthly fees and no fees that are assessed for slightly late payments; the only fee you have is a $19 annual fee. This is very low for a credit card that is intended for people with a less than perfect credit history.

What is the best feature of this card? There are no balance transfer fees! This is an incredible perk for individuals who are currently carrying balance on other high-interest credit cards. You will save a lot of money by paying lower interest rate, and this will bring you one step close to becoming debt free!

Platinum Status is Something Everyone Can Achieve

Don’t sit there and settle for a poor credit credit card that does not work for you. The Capital One Standard Platinum card wants you to be privileged to have a great credit card regardless of your situation. So start to change your life and credit score right now! You will see a great improvement in just a few short months if you stay on top of your payments.

Click here to apply for the Capitol One Standard Platinum Credit Card

Additional Resources:

Are you looking for a cash back rewards program for people with average credit history? Your Credit Network has the right card for you - the No Hassle Classic Cash Rewards Card from Capital One Bank. This post will cover the basics of this No Hassle card and how its reward program is setup to help you earn cash back bonuses every time you shop.

Capital One No Hassle Classic Cash Back: Credit Card Basics

- $0 annual fee

- 16.89% Variable APR

- No application or participation fees

- Designed for those who have average credit

- Rebate Rewards

This is a No Hassle Cash Rebate Reward Program that You Will Want!

Are you in the mood for a cash rewards card has all the perks? Then you are ready for this Capitol One card! It is easy to use, and it has a the highest, least restricted cash back program out of all of the cash rebate cards available.

As for the cash rewards program:

- 1% cash back on all purchases, regardless of purchase type or location

- 25% bonus on cash earned during the previous year through October 31st

- Rebates have no expiration date

- Cash or check rebates can be requested any time

So let’s recap. You do not have to pay any fees and you get a card that gives you great cash back rebates. Combine that with no expiration dates, and you can really see why this card is a No Hassle Classic. There is not even a limit to what you can earn in any given year! Now you can see why Capital One Cards are thought of so highly within the wide world of credit.

Click here to view the rewards of the Capitol One No Hassle Classic Cash Rewards Credit Card.

Don’t Settle For Cash, When You Can Have Classic Cash

Get used to the comfort and ease that a Capital One No Hassle Classic Cash Card can bring. All you need is an average credit history and you to take a step back and appreciate the finer things in life, like easy-to-redeem cash rewards! Isn’t it about time you get a rewards card that you won’t have to worry about? Start earning those great cash rebates right now!

Click here to apply for the Capital One No Hassle Classic Cash Card.

Additional Resources:

New to Your Credit Network is the Capital One No Hassle Premium Miles Rewards Card. This blog entry will explain the card’s basic features, its rewards program and how it compares to other credit cards with frequent flyer bonuses.

No Hassle Premium Miles Rewards Basics

- 13.89% Variable APR (this is very low for an airline rewards card)

- No annual fee

- Designed for those with excellent credit

- Miles-based rewards program

Premium Miles Rewards Program

The Capital One No Hassle Premium Miles Rewards Card has one of the best miles based rewards programs around. Cardholders can earn 1.25 miles for every dollar spent on any purchase. These miles are redeemable for flights on any airline and there are no blackout dates! Miles can also be redeemed for cash, merchandise and gift certificates. You can even donate the miles to charity if you choose to do so. The only drawback is that the miles can’t be used in conjunction with frequent flyer mile accounts.

Capitol One also includes benefits such as roadside assistance, extended warranties and travel accident insurance. The card is also one of the most accepted cards all over the world.

Click here for more information on this great rewards program.

Fly Away to Paradise

The Capital One No Hassle Premium Miles Rewards Card may very well be the best airline rewards card on the market. The card is designed for those with excellent credit, and it offers the highest ratio of miles per dollar (1.25 to 1) of any other card on the market. It also has a reasonable APR and no annual fees. Have you ever had a credit card that offers you rewards miles, but then never lets you fly when you want to? Why should you have to fly at 2am on a Tuesday morning on a week that is not even close to any major holidays? No blackout dates for this card, fly wherever you want! This is an excellent card.

Click here to apply for the Capital One No Hassle Premium Miles Rewards Card

Additional Resources:

New to Your Credit Network is the Capital One No Hassle Premium Cash Rewards Card. In this blog entry we will discuss the card’s basic features, its rewards program and how it stacks up when compared to other credit cards.

No Hassle Premium Cash Rewards Basics

- 13.89% Variable APR

- No annual fee

- Rebate based rewards program

- No introductory rate or application fee

- Designed for those with excellent credit

Premium Cash Rewards Program

The Capital One Premium Cash Rewards Credit Card offers a very solid rebate-based rewards program. You can get 1% cash back with every purchase you make, and you also get a 25% annual bonus on the cash rewards you have earned throughout the year. There is no limit on how much cash rewards you can earn and your cash rewards will never expire. The card also comes with no additional fees for purchases made outside the United States, travel accident insurance and 24 hour roadside assistance.

Visit this page to find out more about the rewards program.

Capital One’s Premium Cash Back Rewards: An Excellent Choice

The Capital One Premium Cash Rewards Card is a good card for those with excellent credit. In order to apply for the card you must have an excellent credit history, which typically means:

- You have never declared bankruptcy

- You have never been over 60 days late on any type of payment, bill or loan

- You have never defaulted on any type of payment

- You must have a credit card with a credit limit exceeding $10,000

If you fall into all these categories then you can get the Capitol One Premium Cash Rewards Card. It’s an excellent card with a low APR and no annual fee. Combine that with a good cash based rewards program and you have the makings of an excellent card for those with excellent credit. If you do not qualify for this card another good option for you is the Capital One No Hassle Standard Cash Rewards Card. It contains the exact same rewards program and is designed for those whose credit is less then excellent.

Click here to apply for the Capital One No Hassle Premium Cash Rewards credit card.

Additional Resources:

Are you in the middle of credit problems? Well if you are looking to get your credit back on track while earning great cash rewards, then Your Credit Network has the card for you. It is the No Hassle Standard Cash Rewards Card from Capital One Bank. This post will cover the basics of this rewards card and how its reward program is setup.

Capital One No Hassle Cash Rewards: Credit Card Basics

- $29 annual fee

- 16.89% Variable APR

- No application or participation fees

- Designed for people who have credit problems, but are working to fix their situations

- Cash Rebate Rewards

Click here to view the complete basics of the Capitol One No Hassle Standard Rewards Card

No Hassle, Great Cash Rewards!

Rewards are something that all of us want to earn, but depending on your credit condition these rewards may be just out of reach. Past or current credit troubles, in most cases, may completely deny any chance you have for a card with rewards. Cards you may be eligible for will often have high rates, and a lot of fees.

That’s where the Capital One Standard Cash Back Rewards card comes in. Here is a list of rewards you can earn:

- 1% cash back on all purchases, no matter what you buy

- 25% bonus on cash earned during the previous year

- Rebate credit or check can be requested at any time

- No expiration date on the rebates

Earning your cash back is something we all want to take full advantage of whenever we get the chance. Normally you would expect to pay high fees in your credit situation, but wouldn't you jump all over the chance to get these great rewards and only have to pay a $29 annual fee? Capital One has always prided itself on No Hassle, and that means they will not take your money at every turn. So if you have credit problems, and want to help yourself get back on track while earning great rewards, this is your card. You can get your rewards at anytime! They will not tell you when and where to spend your rebates. Plus, there are no expiration dates, so you will not feel rushed.

Don't Let Credit Troubles Hold You Back

Capital One Bank wants you to be aware of the comfort that come with owning a Capital One credit card. Even if your situation would generally call for something different, they will treat you the same. So if you have credit troubles, let those concerns be eased by the Capital One No Hassle Standard Cash Rewards credit card. You will find that this card is everything you want from a bad credit rewards card. Apply for this card today and start earning cash back rewards tomorrow!

Click here to apply for the Capital One No Hassle Standard Cash Rewards Card.

Additional Resources:

New to Your Credit Network is the Capital One Platinum card. In this blog entry we will cover the basics, what it can do for you and how it stacks up to other cards.

Capital One Platinum Basics

- 19.79% Variable APR

- No annual fee

- No introductory rate

- Designed for people with bad credit or a limited credit history

What the Platinum Card Can Do For You

With a Capital One Platinum card you will enjoy benefits such as:

- World Wide Acceptance - Take your Capital One Bank Card anywhere in the world.

- Master RoadAssist - Enjoy emergency roadside assistance anywhere in the United States.

- Travel Assistance - Enjoy emergency travel assistance if you are traveling at least 100 miles away from your home. Also included are medical and legal referrals, cash transfers and destination information.

- Global Service - Enjoy emergency customer service, such as lost or stolen cards, quick card replacements and cash advances, anywhere in the world.

Building Good Credit

The Capital One Platinum card is designed for those with a limited credit history that might have getting credit cards. With the No Hassle Capital One Platinum Card you can take advantage of the platinum benefits to help improve you credit rating. It can be hard to find a good credit card with no credit history; this card can help you build that history.

Click here to apply for the Capital One Platinum credit card.

Additional Resources:

Have you seen this great Capital One Bank credit card from Your Credit Network? It is the Class Platinum card from Capital One, and if you have average credit history and want the security of a dependable credit program, this is definitely the right card for you! This post will cover the basics of this platinum credit card and why it may fit with you.

Capital One Platinum Classic: Credit Card Basics

- $0 annual fee

- 12.89% Variable APR

- No application or participation fees

- Designed for people who want a card with great benefits and a great APR

- For people with average credit history

Click here for the full list of basic information.

You Need a Classic Platinum Card That Will Work For You

You know you deserve better than average, so why not make that dream a reality? The Capitol One Classic Platinum credit card makes it easy to have a card that has a great APR as well as great benefits. A great part of this card is you do not have to have excellent credit, but Capital One will still treat you like a VIP with their award-winning 24/7 customer support!

Perhaps the most attractive feature of this classic credit card is the 12.89% variable interest rate. This is lower than you would see on most other platinum cards. So you will not have to worry about the hassle of a large APR.

Did I forget to mention that there are no balance transfer fees? So if you want to transfer those other balances from higher APR cards then go right ahead! If that was not enough, Capital One makes things easier by charging no added fees when you make purchases outside of the United States. It is your money, and Capital One cards think that you should keep as much of it as possible.

So let’s recap: low APR, no annual fee or other fees, and no fees on purchases outside of the United States. What a deal!

Get a Classic Card at a Fantastic Rate

Don’t feel left out in the cold. Great APR and great benefits are something that Capital One really believes that everyone should be entitled to having. Find out more about this great Platinum card, and why it wants to be the card of your choice. They want you to take full advantage of all the great services that have for you. Don’t wait any longer -- now is the time to get a credit card you can be proud to use every day!

Click here to apply for the Capital One Classic Platinum credit card.

Additional Resources:

New to Your Credit Network is the Capital One Platinum Max card. This is an exciting addition to Your Credit Network and in this blog entry we will cover the basics of the card, its strengths, and how it stacks up to other cards in the Capital One series.

Capital One Platinum Max Basics

- 9.9% APR

- No annual fee

- Balance and transfers guaranteed for three years

- A simple credit card – no rewards program, just a low interest rate and great customer service when you need it

No Rewards, No Problem!

Credit card rewards programs are nice things (in theory) but they are also well-known for complicating an otherwise simple process. Credit card reward programs often times only reward you after you have spent a rather large amount of money, and they reward you with a prize that is not even close to being worth the amount of money you spent. It seems almost unfair that you must spend thousands of dollars to receive a free t-shirt, or get other rewards that simply don’t turn out to be everything you wanted.

Low APR? You Bet! Capital One’s Platinum Max Card Delivers…

Capital One has brought you its branded “No Hassle†credit cards for years and their finest card just might be the Capital One Platinum Max card. Although it doesn’t have a rewards program like other cards you see, the beauty of this program is in its simplicity: the incredible 9.9% APR. The card also comes with $100,000 worldwide travel accident insurance, 24 hour roadside assistance, emergency card replacement or cash advance, and rental car insurance.

A Max-terpice

If you think that rewards programs are a tad overrated, then this is definitely the best Capital One credit card for you. This card is designed for those with very good credit and can be very beneficial for individuals who intend to carry balances from month to month. The bottom line is the Platinum Max is one of the better credit cards you are going to find and – reward program or not – it’s definitely worth a look

Click here for a full credit card review of the Capital One Platinum Max card.

Additional Resources:

Your Credit Network is now proud to be a partner with Capital One Bank. With that partnership, YCN is now home to 10 great Capital One credit cards, and the subject of today’s post will be the Capital One No Hassle Miles Visa Signature. This post will cover the basics of this credit card as well as the great reward possibilities that you can enjoy if you apply for this credit card today.

Capital One No Hassle Miles: Credit Card Basics

- $39 annual fee

- 13.89 Variable APR

- No application or participation fees

- Miles Rewards

Do You Want Airline Rewards? Think Capital One Visa Signature!

We are not dealing with any regular credit card that has miles rewards; this Capital One card is without a doubt one of the least costly airline miles reward cards out right now. Not only that, but the card overall is arguably the best in the airline rewards category.

In most cases, a great rewards program means spotty customer service and high interest rates, but with this credit card it is exactly the opposite. The Capital One Visa Signature allows you to have your cake and eat it too – there is a reason why this card is a member of the “No Hassle†network!

Some features of this airline reward program include:

- 2 miles per $1 spent

- Miles redeemable on any airline

- No blackout dates

- Miles also redeemable for cash, merchandise, or can be donated to charity

Click here for a complete listing of airline reward options & benefits.

You read that correctly, 2 miles for every 1 dollar you spend on purchases… how amazing is that! Most programs only offer one mile per dollar spent, so now it’s easy to see why this card is so hard to pass up. With only a $39 annual fee (and no other fees) the decision to apply is not hard.

Credit cards that offer the “2 for 1†airline mile package will try to make it up in high yearly fees and costs; worse yet, the miles themselves may be subject to any number of rules or restrictions. With the Capital One Visa Signature, you can redeem your miles on any airline, and no blackout dates will ever apply. It doesn’t get any better then that!

Switch Miles for Points, Cash, or Other Rewards

If you do not want miles, then feel free to redeem them for cash, or even merchandise. Better yet, why not give to your favorite charity? The Capitol One Visa Signature lets you spend your rewards your way, so don't settle for 1 mile per $1 when you can double that – and then some!

Click here to apply for the Capital One Visa Signature credit card.

Additional Resources:

Do you have bad credit, but still want to earn rewards for purchases? Your Credit Network has the card you will want. The Ultra VX Visa Card from MetaBank. This blog entry will cover the basics, and the rewards of this bad credit rewards card.

Ultra VX Visa Card Basics

- No annual fee

- 18% Fixed APR

- Credit-On-Demand option

- Point Rewards

Get Ultra Rewards With This Card!

Now because of your bad credit standing, it is standard to pay some fees with these cards (especially ones that offer rewards). But the Ultra VX card sets itself apart because the fees are much smaller. You do not have an annual fee which starts this card off great. There is no inactive fee either. So you can see they are not trying to fee you at every chance. You do have a small application fee, but after that, the participation fee is only $6.95 per month. So that is not much for a great card. Plus you get some great reward opportunities. The reward details are:

- 1 point per $1 spent

- Points can be redeemed for travel rewards

- Southwest Airlines, American Airlines, jetBlue, Marriott, plus more

Travel rewards are something that all of us can really use. These rewards are great because they are something you actually want to use, instead of some points to a random store you have never heard of. this card wants to show that even bad credit situation can be deserving of great rewards. This is the whole package. A small number of minimal fees, and great rewards is a combination you would be hard press to pass up. See why this card is highly thought of and approved by many. We trust that you will think of it the same way. So get to know a little more about this card, then sign up if you believe it is the right card for you. We think you will like what you see.

Let MetaBank and Visa Get You a Great Card Today

Now that you have seen what great rewards you can earn, the time is now to sign up. Get rewarded even though you have less than perfect credit. Plus, you can use this card to help turn your credit around, so that is a bonus. This card is really meant for bad credit situations, and it really wants to help pull you out of your credit funk. So don't wait any longer. Apply now for this great card and watch the rewards come rolling in!

Click here to apply for the Ultra VX Visa Card

Additional Resources:

In need of a good prepaid card? Well, Your Credit Network has one for you. The All-Access MasterCard Prepaid Card from MetaBank. This blog entry will cover the basics, and the advantages of this prepaid credit card.

All-Access MasterCard Prepaid Card Basics

- No annual fee

- $0 account to account Internet transfers

- Direct deposit

- No first year fees

A Prepaid Card With Low Cost

Usually, you would expect a prepaid card to slam you with huge fees and lots of them. This is where the All-Access card sets itself apart from the others. Don't you want to keep your money? With this card you get a great prepaid card, with the ability to keep that moneyall to yourself. You also have the choice between two different plans. They are the pay per transaction plan and the FeeAdvantage plan. They both have different structures, and different small fees. So do your research. The fees that this card has are small, so don't worry. The fee list includes:

- $0.50 account to account transfer via the phone

- $4.95 account to account transfer via live agent

- $0 possible on 4 different fees

It is not just talk with this card. They really do have smaller fees than the other prepaid cards. This card is really great for someone who is having troubles finding and obtaining an unsecured card for their finance needs. This card is also beneficial to someone who wants to get a card that lets them pay for purchases in advance. Plus you still are eligible for great benefits and services even though there are limited fees. How can you not be a fan of that? This is something you do not find in every prepaid card. So it is easy to see why this card is something that everyone should think about adding to their repertoire. So get to know a little more about this card and see if it features something you would want.

Get All-Access With This MasterCard Prepaid Card

It can get frustrating to find a prepaid card that works for you. But don't give in and just apply for any random one. MetaBank and the All-Access Card are sure that you will see it stands out above the rest. So compare this card with other prepaid cards and see what you think. You will be pleasantly surprised. Read the terms and conditions before you apply. Then apply today, and get a great prepaid card!

Additional Resources:

Ready for this new card from Your Credit Network? The Account Now Vantage Debit Visa Card. This blog entry will cover the basics, and the great aspects of this prepaid credit card.

Account Now Vantage Debit Visa Card Basics

- Low annual fee

- $0 for direct deposit on card

- Free bill pay service for the first seven transactions each month

- No inactive fee

Do You Need a Prepaid Card?

This card is great for you if you have trouble obtaining an unsecured credit card. No bank acount, no worries! You do not need a bank account for this card, instead all you need to do is make payments in advance. But do not worry about these payments, because they help you. They will generally offset some of the future costs that will occur with this card. So it is not like you are throwing money away. You will have it returned to you in some fashion. Usually you would expect really large fees with a card like this. But that is not the case. The fee list includes:

- $19.95 Annual Fee

- $4.95 Monthly Fee

- $79.35 First Year Fee (Combined Fee)

So as you can see, they have reasonable fees. So you do not have to worry about signing your funds away. Which really helps, because it is your money, so you need to be able to spend it on things you want! You even get a free bill pay service with this card for the first seven months. You also have access to a great free credit building service. So this card looks to help you out, which is something you should expect from your card. It is time to put down that card that just abuses you and does not give anything back. You do not have to settle for one set form of card use. There are three unique plans and they all differ in fees and services. So you have great options you need to review and look at.

This Account Now Debit Card is For You!

Don't settle for a pre paid card that charges you a ton of money to use it. You deserve better then that. Great flexibility comes standard with this debit card. Isn't that something you want? Isn't that something that you deserve? It should be. So don't wait any longer. Sign up for this great new prepaid card today. You will not be disappointed at all!

Click here to apply for the Account Now Vantage Visa Debit Card

Additional Resources:

Hey students, here is a great card for you from Your Credit Network! It is the Discover Open Road Card for Students. This blog entry will cover the basics, and the rewards of this great new card aimed directly at college students.

Discover Open Road For Students Credit Card Basics

- No annual fee

- 16.99% Variable APR

- 0% introductory rate on purchases for 6 months

- Rebate Rewards

Even Students Should Earn Rewards With Discover Open Road

This card is for students who really want to earn rewards with their card. Many students have problems choosing which credit card is best, but this one is definately a winner. This card helps those students whose spending during college is often budget controlled. You can also be rewarded for purchases on crucial aspects of our society now. That is spending on gas and maintenance on your automobile. You give and give to those assets, and it seems like you never get back. The time to get back is now. The rewards program includes:

- Spend up to $1,200 in gas and maintenance purchases per year and earn a 5% rebate

- Earn rebates at participating discount stores

- Earn double Cashback Bonus points with participating rebate partners

- Fraud protection services

This is no minor reward program. You get cash back when you spend money on gas. How can you not want that? Make those trips to the gas pump a lot easier, because you will get some of that back. A 5% rebate is a good return. These rewards can be returned to you in $20 increments. Plus there is no expiration date on this card, assuming the card does not go inactive for more than 36 months. But, no big worries there. Also, there is no annual limit for rewards on this card. Aren't car troubles a hassle as a student? Well, get back money on that spending also! Don't use another card to budget your college funds, and student spending. Allow the Open Road the opportunity to reward you for your purchases.

Get This Great Student Card Today!

Jump on the Open Road and ride carefree. Nothing should stay between you and great rebates. The appeal of this card is great, because of how you can be rewarded for spending money on gas. Combine that with an auto maintenance you may have, and you are dealing with great features. Don't worry about paying large fees either. Discover knows that you are a student and with that comes major spending and minimum cash flow. That is why they feel you need to be rewarded too. Discover has the solution for finding the best card for students over 18. So don't wait any longer. Apply now and get those rewards you and all the other students deserve!

Additional Resources:

Trey Knox

Team Your Credit Network

Your Credit Network has a new card for all you American Express card lovers out there. It is Clear from AMEX. This blog entry will cover the basics, and the rewards of this impressive new card.

Clear from AMEX Credit Card Basics

- No annual fee

- 14.24% Variable APR

- 4.99% introductory rate for balance transfers

- 0% introductory rate on purchases

- Rebate Rewards

American Express Offers Great Rewards With the Clear Card

This card is made for those who have good credit and are looking to earn some very easy rewards. American Express wants to reward you for being a great loyal customer with this credit card right for you. You can get a reward that is easy to use, and something you can use on what you want. You will not get a reward that you have to spend on a place they tell you to. Easy rewards are something we all want, isn't it? The rewards program includes:

- Cash rebate of 1% on all participating purchases

- Earn a $25 shopping card for every $2,500 spent

- Absolutely no fees!

- Emergency card replacement

Wait....no fees?? That is an amazing addition to a great rewards program. How often do you find yourself spending your money on little fees that do not make much sense? This eliminates those, and just gives you a good card with a great reward program. You also have one whole year to use the card until it expires. So there is no major rush to use it. There is also no annual limit to how many shopping cards you can earn, so do not worry about that. This card has everything you are looking for. A great reward program, and no fees! How can you not want to own one of these cards? Now you can see why this card is getting great reviews and becoming very popular.

See Clear With This Amazing Card!

Don't let other credit cards cloud your mind. You need to think Clear! It has to be important to get great rewards with a great credit card. This card allows you just that. Remember, no fees! That has got to be more appealing then other other thing. Because not only are you getting rewards, but you are saving money by not spending it on ridiculous fees and charges. Don't wait a minute longer. Apply now and start earning your great rewards, while having a solid credit card that you can be proud to own.

Additional Resources:

Trey Knox

Team Your Credit Network

Here is one of the new, amazing cards found on Your Credit Network. It is the Discover Open Road Card. This blog entry will cover the basics, and the rewards of this great new card.

Discover Open Road Credit Card Basics

- No annual fee

- 10.99% Variable APR

- 0% introductory rate for balance transfers for 12 months

- Rebate Rewards

Earn Rebate Rewards From The Discover Open Road Credit Card

If you like to earn cash rewards, and you have very good credit then this is the right card for you. This card is geared at helping the loyal Discover customers earn rewards for their auto maintenance spending and gas purchases. Are gas rewards something everyone wants to cash in on right now? We aren't talking about something that is hard to earn either. The rewards program includes:

- Earn a 5% rebate for up to $1,200 in gas and maintenance purchases

- Rebates can be earned at select discount stores

- Get double Cashback Bonus points with participating partners

- Travel accident insurance

As you can see, it is a great reward program. You get actual rebates with this plan. How refreshing would it be to use this card at the gas pump knowing you will get money returned to you? A 5% rebate is such a great return. You aren't getting a small rebate with this card. There is no expiration date on the rewards. The account cannot go inactive for more than 36 months. But that is not a big deterrent. Plus, you do not have an annual limit on the amount of points you can earn. This card is something you definitely need to get into if you spend alot on your car, because it will be great when you see a return on all of your spending. Knowing that your rewards card really rewards you is a great feeling.

Get This Card And Head Out On The Open Road!

The Open Raod is calling. Will you answer that call and start to earn great rebates? If you fix up your car a lot, then you will enjoy this great card. You may be attached to your old credit card. But that card probably does not have the fantastic benefits this one does! You will not have to pay large fees to be able to use this. That is always something you should want in your card. So apply now and start getting some of your money back on your important auto maintenance and gas purchases.

Additional Resources:

Trey Knox

Team Your Credit Network

Bank of America has done it again! New to Your Credit Network is the BoatU.S. Platinum Plus Visa Card - now there is a card out there for the boating enthusiast that offers some great features and unique perks.

Say Ahoy to the Boat US Platinum Plus Visa Card

Do you enjoy hitting the seas on a beautiful day? Well now all you need is to bring your BoatUS credit card along with you. This card is designed for boaters who have great credit and love a credit card that gives back. Through the world points reward program card holders have the ability to earn one point for every dollar they spend on the card. These points may be used for some great things such as cash rebates, travel, merchandise, gift certificates, and more. Now as you are traveling from port to port you have the ability to rack up some great rewards. You do have to use the points up within 5 years after they are earned or else they will expire. So get on the main land and be prepared to use your rewards this great platinum plus card offers.

BoatUS Platinum Plus Visa Credit Card’s Attractive Features

- Introductory Rate: 0.00%

- APR (Purchases): 9.90% Fixed

- Annual Fee: $0

- Points per Dollar: 1 Point

Enjoy the Perks of the Boat US Credit Card

A rewards program is a greatly desired feature to have with a credit card, well now boaters have the opportunity to get a card that can cater to their everyday needs. Going out on the water and enjoying a beautiful day is what boating is all about. Why should you have to ruin a great day because your credit card doesn’t fit your life style? Well not anymore! Not only do people who enjoy boating get to earn points on every dollar they spend, but they also get some great perks when they use their BoatU.S. Platinum Plus Visa Card at designated places. Here are just a few of those great deals:

- Free Shipping on Your Order of $100 or More from Hammacher Schlemmer.

- Complimentary Champagne + Daily Breakfast at The Luxury Collection Hotels & Resorts.

- Onboard Credit of up to $200 on Oceania Cruises.

- 10% Off Your Order at Overstock.com.

- And over 100 more!

Check out the BoatU.S. Platinum Visa Card application page for more great perks offered.

Additional Resources:

Jay Dobbins

Your Credit Network Contributor

The latest addition to Your Credit Network is the Discover Business Miles Card issued by Discover/Morgan Stanley. This blog will examine the card's great features and give you insight on what it means to have a stellar business miles card from Discover.

Discovering What the Discover Business Miles Card has to Offer

Are you always on the go for business trips? If so, you need a credit card that can start giving back. The Discover Business Miles Card is designed for those with very good credit who plan to take advantage of the travel reward program. Why should you dish out endless amounts of money for your business-related travel only to get nothing in return? Well now you can! Discover has put together a perfect reward program allowing cardholders the ability to earn double miles on up to $5,000 in travel and gas purchases; they also give one mile for every dollar spent on general purchases. Redeeming your miles is easy and they can be used toward airfare or reduced airfare on most major U.S. based airlines. Cardholders also have the ability to redeem miles for gift cards from 50 brand-name partners. A great feature is that there is no limit to the amount of points a cardholder can earn and points do not expire, which is not commonplace with most business credit cards currently on the market.

Attractive features of the Discover Business Miles Credit Card

- Introductory Rate: 0.00%

- Annual Fee: $0

- Balance Transfer Fee: None

- Additional Miles: Earn double miles on up to $5,000 in travel and gas purchases.

The Perks of having a Business Miles Credit Card

Everyone wants a great rewards program, so why shouldn’t you have a great business card that is going to give back great deals specifically designed for the modern executive on the go? Now you can have just that! Traveling for business can be very expensive, and what's worse is there is no easy way to get around it. Having a card that can give back to you really can help you out and save you a pretty penny over time. In addition to airline bonuses and cash savings, here are a few perks that this business cash card has to offer:

- 30% Off + Six 1/4 Pound Steak Burgers Free from Omaha Steaks

- Up to 20% Off Purchases at Lenovo

- 20% Off Your Floral Order at FTD.com

See the Discover Business Miles Card for additional perks this card offers.

Additional Resources:

Jay Dobbins

Your Credit Network

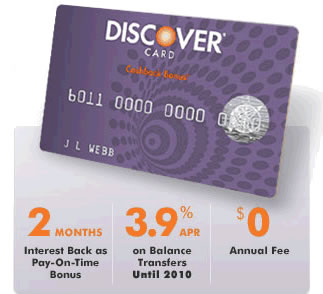

This card has amazing rewards for people with good to very good credit. If you continually make purchases and pay your monthly bill on time, this card is definitely one of the best choices out there for a credit card rewards program.

Discover the Motiva Credit Card Rewards Program

If you spend up to $1,500 during one billing cycle, you will receive a .25% rebate; if you spend even more, you receive larger percentages in cash back form. For instance, spending between $1,500 and $3,000 will get you a return of .5%, and over that you will receive a 1% rebate. Discover also gives you an additional .25% return if you spend money at select discount stores and warehouse clubs as well. Sound too good to be true? Wait until you read about the other great bonuses.

If you like shopping online, then you're in luck. Make any purchase on Discover's exclusive online shopping site, and you are eligible to receive 5% to 20% cash back. If you don't take advantage of this money right away, you can rest assured that any points or cash back rbates you earn do not expire as long as the card is active, and there is no limit to how much you can earn in total rebate value.

Motiva's On-Time Payment Bonus

If you pay on time, you can receive Discover's "pay-on-time" bonus. What this means is that when you do pay your monthly bill on time for six months straight, you will be given some credit to go toward the next months interest - the offer extends through the lifetime of your account, so you may continue to take advantage of this unique reward type every time you pay your bill.

The introductory APR is a mere 3.9% for the first ten months, and this applies to balance transfers as well. After these ten months, the APR is relatively low for those who qualify for the card, so make sure your credit score is right where you'd like it to be before you apply for the Discover Motiva Credit Card.

There is a whole host of other fantastic services that accompany this credit card, including auto rental insurance, fraud protection, $500,000 in flight insurance, and more. See the complete Discover Motiva Card review for more information about these benefits.

Additional Resources:

Amanda Robbins

Your Credit Network Contributor

That’s right - Citibank has issued the much anticipated Citi Professional Cash Card. Your Credit Network wants to be the first to offer you all the information such as the basic features of the card, reward programs, perks and how it measures up among other cards.

Go Pro with the Citi Professional Card with Cash Rewards

Looking for a business cash card that can handle all your needs? Well the Citi Professional Cash Card is just that. With this credit card business owners and professionals do not need to be carrying around several different cards making it confusing and difficult to pay bills. One card can do the trick by taking care of all your credit needs while eliminating the work of separating business expenses from personal expenses. If you are looking for a card that shouts class and sophistication that look no further; the Citibank Professional Credit Card has many attractive features, ranging from free reward programs to cash back incentives and other great perks. Professionals that tend take advantage of the rewards program and the additional benefits will get the best use and benefit from this new cash card the most (if that's not you, consider getting a different business credit card without all the bells and whistles.)

Attractive features of the Citi Professional Cash Credit Card:

- Annual Fee: $0

- Introductory Rate: 0.00%

- Introductory Rate Details: There is no balance transfer fee with this offer

- Additional Cardholders: $0

- Additional Rebates: Earn 3% on purchases made at restaurants, gas stations, certain office supply merchants, and on auto rentals.

Let’s Keep it Professional

Having a professional business card that earns you money for your everyday purchases is incredibly rewarding. Being in the business world can be very tough, and having many perks associated with you cash card can take a major burden off of your shoulders. Whether you are picking up a few supplies or taking a client out to dinner, you can use you professional cash card and get some major perks along the way. Here are a few perks that this business cash card has to offer:

- Up to 20% Off Your Car Rental + More through Alamo

- 15% Off Your Luggage Order + Free Shipping through Samsonite

- 20% Off any TurboTax Online Federal Product

- 25% Off Newsstand Price on USA Today

See the Citi Professional Cash Card for additional perks this card offers or click here to apply for the Citi Professional Card now!

Additional Resources:

Michelle Perkins

Your Credit Network Contributor

New to Your Credit Network is the Chase Freedom Cash Visa Card issued by Chase. This blog entry will go over the card basics, its rewards program and how it stacks up to other cards.

Chase Freedom Cash Basics

- No introductory rate

- No annual fee

- 5.99%, 9.99%, 14.24% APR + prime rate

- A unique rebate based rewards program

Chase Freedom Card with Cash Rebates

The Chase Freedom Cash card offers a very unique rebates based rewards program. You can earn 3% cash back on every dollar you spend at a grocery store, gas station or quick service restaurant. You will earn 1% for every dollar spent everywhere else. Once you have earned $50 in rewards you can receive a $50 check. When you accumulate $200 in rewards you can get a $250 check. If you desire you can switch to points and use them on travel miles, brand name merchandise and gift cards. The credit card also offers travel accident insurance, rental insurance and emergency travel assistance.

Chase Freedom Cash Credit Card Cashes In!

The Chase Freedom Cash Card is a unique card in almost every way. It is designed for those with solid credit, hence the lack of a annual fee or introductory rate. The interest rate that is assigned to you, based on your credit score, is added to the prime rate making your total interest rate a variable one. This allows for a broad range of people to apply for this card, while rewarding those with really good credit. The rebate rewards system is unique. When you accumulate $200 in rewards you can get a $250 check, that is a $50 bonus that you do not see in most cards. Still, if the rebate cash back system is not for you you can switch back to a points based system instead. With its varying interest rates, unique and profitable rebate rewards system, as well as the option to change to a points based rewards system, this card scores highly.

Click here for a full revioew or to apply for the Chase Freedom Cash Rewards Card.

Kimberly Carte

Team Your Credit Network

New on Your Credit Network is the Chase Freedom Card from Chase Manhattan Bank. This blog entry will go over the card's basics, the rewards program and how it matches up to other cards in its field.

Chase Freedom Credit Card Basics

- No introductory rate

- 5.9%, 9.9% or 14.24% APR plus prime rate

- No annual fee

- A points based rewards system that can be redeemed for prizes or cash without losing any value

Chase Freedom Points Visa Rewards Program

With the Chase Freedom Credit Card you can earn various rewards points on various purchases. Earn three points for every dollar spent at grocery stores, gas stations and quick serve restaurants. For every other purchase you get one point for every dollar spent. You can redeem these points on various things. You can use it towards travel miles, hotel stays and car rentals. You can also use the points on various brand name merchandise and gift cards. You can also use the points to get cash back, once you accumulate 3,500 points you will receive a $25 check. You also earn 1,000 reward points with your very first purchase. The Chase Freedom Visa Credit Card also offers travel accident insurance, rental insurance, and emergency travel assistance.

How is the Chase Freedom Visa Card Overall?

The Chase Freedom Card is designed for those with a solid credit score; the fact that there is no introductory rate, application fee and no annul fee attest to that. The card has a fixed APR based on your credit score and is added to the prime rate, making your total APR adjustable. If you qualify for the low interest rates and the prime rate is low, the card is quite a good deal. The variation in interest rate allows more people to apply for it. Just because your credit rating is not perfect does not mean you should not apply for this card. The ability to redeem your rewards for points for cash back is a feature not many credit cards have, and it is what makes this one stand out. If your credit is good and you want variety in choosing your rewards options this is the credit card for you.

Click hereto apply for the Chase Freedom Credit Card with Point Rewards.

Kimberly Carte

Team Your Credit Network

The Elite Rewards World MasterCard Credit Card is a new card in to Your Credit Network. This blog will discuss the basics of the card, how the reward program works, and how it compares to other cards.

Elite Rewards Credit Card Basics

- 0% introductory rate for the first 12 billing cycles on balance transfers and cash advance checks

- Fixed 13.99% APR

- No annual fee

- No application fee

- Point based rewards

Elite Rewards MasterCard Rewards

Earn 1 point per dollar spent when the Elite Rewards World MasterCard is used. The program also gets kick started with 500 bonus points after your first qualifying retail purchase. This card is also beneficial because of its ability to earn double points at participating retailers! Giving you the ability to earn more points quickly, so you do not have to wait long periods of time to get your rewards. The rewards of this card are also beneficial because they are not categorized into one certain area. You can earn rewards that apply to many different areas, including:

- Flight on 125 major U.S. based airlines, with no blackout dates

- Discounts on AVIS car rentals

- Discounts on hotel rooms

- Gift cards to many top retailers

- Gift cards to many top restaurants

As you can see, this card has rewards that help those who travel, as well as though who just look to have a nice night out on the town. The Elite Rewards MasterCard looks to benefit a wide range of people, instead of being targeted at select group. This card sets out to offer rewards that are more accessible to their owner then other similar cards may be.

Elite Rewards World MasterCard Comparison

As previous stated the major appeal of this card to holders is the easy access to the reward points. There is a yearly limit to the points set at 90,000 (7,500 per billing period). But the rewards are set accordingly, so it still does not take long lengths of time to get rewards. Points also expire 4 years after they are acquired. Other cards may be set at 5 year expiration dates, but once again this card takes that into consideration when set rewards. That is seen in the double points feature. That is a feature not many cards have, allowing you to reach rewards in the allotted time. Thus making the point limit less of a concern. Due to the lack of fees and the 0% introductory rate, this card is intended for those with good to perfect credit. Because this card is easy to use, and the great rewards it scores on par to better than similar cards in customer reviews. All this things make the Elite Rewards World MasterCard a must have, and well worth it.

Click here to apply for the Elite Rewards World MasterCard Credit Card.

Jay Dobbins

Your Credit Network

New to Your Credit Network is the Total Rewards Credit Card brought to you by VISA and Bank of America. This blog will feature the basics of the card, how the reward program works and how it compares to other cards.

Total Rewards Visa Credit Card: The Basics

- The introductory rate is 0% for the first 12 billing cycles on balance transfers and cash advance checks

- Fixed 13.99% APR

- No annual fee

- No application fee

- Point based rewards

Total Rewards Card: The Rewards

If you are looking to get a card with a large point bonus following your first retail purchase made with the card, this is it. After your first purchase you will receive 2,500 Reward Credit points. A great feature of the Total Rewards card is that there is no expiration date on the reward points! All you have to do is make sure you accumulate 1 Reward Credit point every 6 months, so there is no pressure or rush to use the card or the points. You can use it whenever you feel like it is right for you. There is, however, a limit to amount of points that you can acquire in one year. You may only acquire 480,000 points (40,000 points per billing cycle), but doing so would require that you spend more than $40,000 per month - so unless you spend that much you have very little to worry about.

This card believes you should be rewarded as much as possible for your spending and has the reward system to match, featuring things like:

- Exclusive vacations

- Gourmet meals at great restaurants

- Hotel room upgrades

- Travel exclusives

- Tickets to the hottest shows

This card also comes with an exclusive feature: added bonuses at any Harrah's casino. If you are a frequent visitor of any of the Harrah's casinos, then you can use your card there for increased bonus points and exclusive offers and promotions. Additionally, every time you use your card in a Harrah's casino you will be rewarded with Reward Credit points, allowing you to use them in any way your want toward hotel services and gambling programs. You can also use www.harrahs.com to keep track of your points and any other questions regarding your use of your point to acquire their services. This exclusive Harrah's casinos feature is a great and useful addition for this card to have - especially if you frequent any casino managed by the Harrah's group!

Total Rewards Visa Card: A Comparison

This card holds a high yearly point limit, allowing you to cash in as much as possible. Another feature that sets this card apart is the lack of an expiration date: you might see 4 or 5 years as an expiration date on some cards, you do not have to worry about that with this card since it will only expire when you want it to. The Total Rewards card teams with Harrah's, but you see added benefits come with that. All these great rewards show that this card looks to help you as much as possible. They are not just worried about you using their card for purchases. If you help them out, they will reward you for it. This card is intended for those with good to perfect credit, and it shows with the lack of fees and 0% introductory rate. So if you are looking for a card with great benefits and great opportunity, then the Total Rewards Credit Card is the credit card for you.

Click here to apply for the Total Rewards Visa Credit Card online.

Gary Edwards Jr.

Team YourCreditNetwork

New to Your Credit Network is the NASCAR RacePoints Visa Credit Card from Bank of America. In this blog entry we will cover the basics, the rewards program and how it compares to other cards of the same type.

NASCAR Credit Card Basics

- 0% introductory rate for the first 12 billing cycles on balance transfers and cash advance checks.

- 15.99% fixed APR

- No annual fee

- A point based reward program that is every NASCAR fan's dream come true

NASRCAR Card Rewards Program

This officially licensed NASCAR credit card comes with a reward program that is almost too perfect for the NASCAR die hard fan. Upon your first purchase you will receive a free NASCAR licensed tailgate chair; after that you get one point for every dollar you spend on net retail purchases, this excludes returns, rebates and money orders. You can redeem these points on these exciting NASCAR products:

- 2,500 points gets you free tickets to the NASCAR Nextel Cup Series Bass Pro Shops 500

- 5,400 points gets you a 1:24-scale diecast car

- 14,900 points gets you a ProScan 100 scanner

- 50,000 points grants you access to driver-introduction red carpet area

- 175,000 points lets you be a crew chief for a day

The card also offers 100% fraud protection, 24 hour customer service and online bill management service.

NASCAR RacePoints Credit Card Finishes in First!

This card is a dream come true for the hardcore NASCAR fan. The unique points based reward system allows you to get cool NASCAR stuff and fulfill all your racing fantasies. The card is meant for those with good credit but has a little higher interest rate, 15.99%, then other cards issued by Bank of America. Depending on your credit score you can lower that rate to 9.99%. The card comes with no annual fee, which is a plus. You can also get the card designed featuring your favorite driver. When it comes to NASCAR fans, all other cards are in 2nd place.

Click here for a complete review & credit card application for the NASCAR Race Points Visa Credit Card.

Jay Dobbins

Your Credit Network

New to Your Credit Network is the Ducks Unlimited WorldPoints Platinum Plus MasterCard Credit Card from Bank of America. This blog entry will cover the basics of the card, as well as its reward program and how it stacks up to similar cards.

Ducks Unlimited Card Basics

- 0% introductory rate for the first 12 billing cycles on balance transfers and cash advance checks

- 13.99% fixed APR

- 7.9% APR if you qualify for platinum.

- No annual fee

- Point based reward system

Ducks Unlimited Card Rewards Program

For every dollar spent on net qualifying purchases using the Ducks Unlimited Card you get one reward point. The qualifying purchases are net retail purchases, and exclude refunds, rebates, money orders, etc. These points are redeemable on the following:

- Travel miles with no blackout dates

- Brand name merchandise

- Gift certificates

- Dining certificates

- Cash rebates and rewards

For every purchase you make the card makes a contribution to the Ducks Unlimited North America conservation effort. This includes the enhancement and restoration of thousands of acres throughout North America. So far $50 million has been raised and this comes at no cost to you!

Ducks Unlimited Card and You Help to Save the World!Feel good, because every time you make a purchase with the Ducks Unlimited Card you are helping to save the world - or at least contributing to the conservation effort. Both this and the normal rewards program make the card a solid choice for anyone with good credit. The APR is low and the card has no annual fee. The card also offers 100% unauthorized card use protection and an on line service to help you manage your account. When you sign up you will receive a pair of Cobra two-way radios. Help the conservation effort and save money!